J L Collins Stock Series Summary

Find the original set of articles here

A generally impressive set of articles about the stock market and the policies to follow for long term success. It is well worth a read and a re-read as a reminder over time.

Summary

There’s a major market crash coming!!!! and Dr. Lo can’t save you

- Dr. Lo claims that the market is faster moving and more volatile (this is probably true). Thus buy and hold is no longer effective (this is probably false)

- Collins view:

- Market crashes are to be expected. They will continue to happen

- The market always recovers from that. The biggest thing to do is to toughen up and let it ride

- The market always goes up. Always. Not always short term or even yearly, but it does.

- The market is the best performing investment class over time. Period.

- The next 40 years will be like the past 40. Recessions and booms alike. Thus we need to toughen up and ride the storm for all of these. We will see 3 or 4 2008’s and 3 or 4 mega bulls as well. Every time the financial media will say this time is different and you need to not listen.

The Market Always Goes Up

But this. This was a whole ‘nother frame of reference. I held tight for three or four months. Stocks continued to drift ever lower. Finally, I lost my nerve and sold. I just wasn’t tough enough. That day, if not the absolute bottom, was close enough to it as not to matter. Then, of course and as always, the market began again its relentless climb. The market always goes up. It took a year or so for me to regain my nerve and get back in. By then it had passed its pre-Black Monday high. I had managed to lock in my losses and pay a premium for a seat back at the table. It was expensive. It was stupid. It was an embarrassing failure of nerve. I just wasn’t tough enough.

- Starts with the above anecdote of the 1987 crash.

- But that incident made him tough enough for 2008, etc. The market, regardless, trends up.

- Of the original 12 Dow Jones stocks, none remain. He swears by VTSAX (3600 companies). Thus he argues that the stock market is self cleansing, companies that die, leave the market. He says to only use index funds as when management tries to beat the system they usually mess things up.

- The upside of a stock is more than 100%, downside capped at -100%. Thus an index fund does really well over time

Most people lose money in the market. (And here’s why)

The Dow started the last century at 66 and ended at 11,400. How could you lose money during a period like that? A lot of people did because they tried to dance in and out. – Warren Buffett

- People panic in tough times, but buy when the market does well. Thus we buy high and sell low

- We believe that we can pick individual stocks

- We can occasionally, and it feels great and is addictive. But in the long run. No.

- We believe we can pick winning mutual fund managers

- There are more mutual funds than stocks… Only 20% of fund managers outperform the market, and they are nearly entirely random in nature. All 100% of managers will charge you lots of money to try though

- We play in the wrong end of the pool

- We tend to get attracted to the gambling side of things (i.e. options). A smart investor will stay far away from it. You can’t predict individual things often, and its impossible to accurately gauge how much of a stock is ‘foam’ vs ‘beer’, i.e. perception v substance.

The Big Ugly Event, Deflation and a bit on Inflation

- Big Ugly Event is the Great Depression. If you bought at peak right before it, it would take you 26 years to properly recover, which human psych cannot handle. Here are some short lessons learned from this

- Never buy stocks on margin

- If a time comes and you read/hear about people routinely making fortunes in an aggressively rising market using margin, something really bad is going to happen soon

- If lesson 2 (the one right above) is happening, it’s a good time to take your chips off the table

- Once a crash comes, its already too late

- Ironically, a crash at the beginning of your investing life is a gift, because you get to buy relatively dirt cheap

- We’ve only ever seen one great depression. They are really rare. 2008 took us to the edge, but we didn’t tumble over. Economic policy growth has seemingly worked.

- Hyperinflation is a problem. Stocks are good at avoiding it if it is a long-term problem (i.e. slow build up), but nothing survives if it’s a rapid upward trend. That just happens.

Keeping it simple, considerations and tools

- In general, the more complex an investment is, the less likely it is to be profitable.

- Active trading may not be a smart idea. It pretty much never is.

- Answer three questions:

- In what stage of your investing life are you: The Wealth Building Stage or the Wealth Preservation Stage? Or, mostly likely, a blend of the two.

- What level of risk do you find acceptable?

- Is your investment horizon long-term or short-term?

- Don’t be too quick to gun for short term.

- Here are the three tools you need:

- Stocks: VTSAX

- Bonds: VBTLX

- Cash (so you don’t need to sell investments to meet emergencies):

- Keep in online bank, physical bank, or money market fund

- He says vanguard is the only company that has your interests at heart (denies any sponsorship). If you cannot find/buy vanguard, then find the closest equivalent. (Discussed further later)

Portfolio ideas to build and keep your wealth

- Wealth Building Portfolio

- Young aggressive and here to build wealth. Put all your eggs in one basket and forget about it. VTSAX

- Put 100% in stocks. Ignore any and all news. But, put in large scale index funds, not individual stocks. The ride will be rough.

- If he put 15,000 in Dow in 1974, its 1 MM by 2011.

- Wealth Preservation Portfolio (i.e. closer to retirement)

- Shift 20% to bonds (VBTLX)

- 5% cash as described above

- Any money on bonds or anywhere else besides stock is underworking. Keep enough that you are comfortable, but realize that.

- You want to be able to live off 4% of the profit/dividends this gives you

Can everyone really retire a millionaire?

- Technically yes, the math checks out. But people suck at investing.

- In general this article has a lot of good math breakdowns of how to handle using your investment money. This is hard to properly summarize, but I would strongly recommend reading it here.

401(k), 403(b), TSP, IRA & Roth Buckets, and should you avoid your company’s 401k

- Divides into two buckets: Ordinary buckets and tax advantaged

- Ordinary: This is where you put tax-efficient investments, like VTSAX

- Tax-advantaged: 401k, roth ira, etc

- Basic rules are this:

- Fund 401(k)-type plans to the full employer match, if any.

- Fully fund a Roth if your income is low enough that you are paying little or no income tax.

- Once your income tax rate rises, fully fund a deductible IRA rather than the Roth.

- Keep the Roth you started and just let it grow.

- Finish funding the 401(k)-type plan to the max

- Consider funding a non-deductible IRA if your income is such that you cannot contribute to a deductible IRA or Roth IRA.

- Fund your taxable account with any money left

- Again this gives good breakdowns that are difficult to properly summarize. This is another smart read on your own

- 401K fees have started to hurt investors to a point where they may not be super economical anymore.

- Recommended Viewing: The Retirement Gamble by PBS

- 2% fees can be devastating, but even worse, Fidelity can force you into lower your class of stocks and that just overly charges you to hell. Pay close attention. Pretty much anyone who isn’t vanguard does this, but in 401k’s you just can’t choose.

- Besides that, assess if your company matches. Figure out where you stand tax bracket wise. If you are in a high tax bracket, just go for it.

Why I don’t like investment advisors

- Avoid money managers

- Management fees suck and will eat you alive.

What if Vanguard gets nuked?

- Vanguard is client-owned, and is operated at-cost

- Unlike money managers, they want to help you because you literally own them

- This is because Vanguard is owned by its own mutual funds, unlike any other company. Even its CEO and Owners just own parts of the mutual fund. So they want to help you succeed.

- He swears Vanguard does not pay him, simple google searches seem to validate what he is saying with regards to structure

International Funds

- Adds risk, due to multiple currencies and lack of accountability in developing countries

- Adds expense, international funds are way more expensive.

- Larger companies that are international trade on US soil anyway.

- If you insist here are recs: VFWAX and VTWSX

Bonds

- VBTLX is his rec

- They provide a deflation hedge, and are less volatile

- Interest Rate risk s a major one. If interest rates vary the price of your bonds will still vary. In general interest rates going up mean bond prices go down, down means up.

- Inflation really hurts if you own bonds, as your values tank.

- If you want to be more active, like him, use VFIDX for intermediate term investments

- This is because he thinks inflation will spike soon

- Even if the bubble bursts, its not terrible

The 4% rule, Withdrawal Rates, and how much can I spend anyway?

- You can take out 4% year over year of your investment and be just fine. He continues to argue for most people, you can even take out more

- Here are his cliff notes stolen directly:

- 3% or less is a near sure bet as anything in this life can be.

- Stray much further out than 7% and your future will include dining on dog food.

- Stocks are critical to a portfolio’s survival rate.

- If you absolutely, positively want a sure thing, and your yearly inflation raises, keep it under 4%. Oh, and hold 75% stocks/25% bonds.

- Give up those yearly inflation raises and you can push up towards 6% with a 50% stock/50% bond mix.

- In fact, the authors of the study suggest you can withdraw up to 7% as long as you remain alert and flexible. That is, if the market takes a huge dive, cut back on your percent and spending until it recovers.

- Here are what fees do to you:

- “For an example of this, the 50-50 portfolio over 30 years with 4% inflation-adjusted withdrawals had a 96% success rate without fees, 84% success rate with 1% fees, and 65% success rate with 2% fees.”

Deflation, the ugly escort of Depressions

- Lowering of prices and increasing value of money.

- Good at small levels, but when it scales up enough companies die that you become unable to get a job or buy bread.

- You win if you hold cash, bonds or have guaranteed fixed income

Target Retirement Funds

- Vanguard naturally has them. Just pick the year you plan to retire and that becomes your fund. These manage things well for you

- They basically put it in three different funds for you

- It is more work, but beneficial to do this yourself in certain percentages

Index Funds are really just for lazy people, right?

- No, they just do better

- In general unless you are Warren Buffet 2.0 you aren’t going to do well.

- In short, more effort more or less == less return

- Basically, at most, you should have some small level funds to fiddle with

What if you can’t buy VTSAX? Or even Vanguard?

- Can effectively substitute ETFs and Mutual Funds

- Provides other VTSAX equivalents that relate to things permitted in 401(k)s

- If you cannot find a way with Vanguard look for the following:

- A low-cost Index Fund

- For tax-advantaged funds you’ll be holding for decades, I prefer a Total Stock Market Index Fund, but one tracking the S&P500 index is just fine too.You can also look for a Total Bond Market Index Fund. Most plans will also offer these.

- Target Retirement Funds are frequently offered in 401k plans and these can be an excellent choice. But look closely at the fees. They are always higher than those for index funds, sometimes by a lot depending on the company offering them.

- Do ~75% in stocks, ~25% in bonds

Investing in a raging bull

- Fear of an inevitable crash is natural. You need to learn to deal with the fear. Fear and greed are the two biggest things that drive investors

- Remember that no one can time the market.

- Listening to news reports is just asking for trouble, you will lose out on money if you let it get to you

- To even be able to predict market timing, you need to guess correctly twice, where the high is and where the low is.

- If you aren’t able to watch your money/value cut in half and sit and wait, don’t play the game. You won’t make it through.

How to think about money

- Its not just about spending. Money will always have uses of ever increasing cost

- Mike Tyson blew 300 million dollars for example

- Instead of thinking what your money can buy, think on what it may be able to earn!

- Another example, buying a car for 20k is fine, leasing or borrowing money for it is just saying I want to pay extra

- Make sure you account for opportunity cost, ie money spent is money not invested

- Buffett lost 25 Billion in 08-09. He kept buying anyway (that’s ~50% of his net worth). He came out way richer.

- Index funds purely work because there is a minimum amount that something can drop in value, but an infinite upside.

Early Retirement Withdrawal Strategies and Roth Conversion Ladders from a Mad Fientist

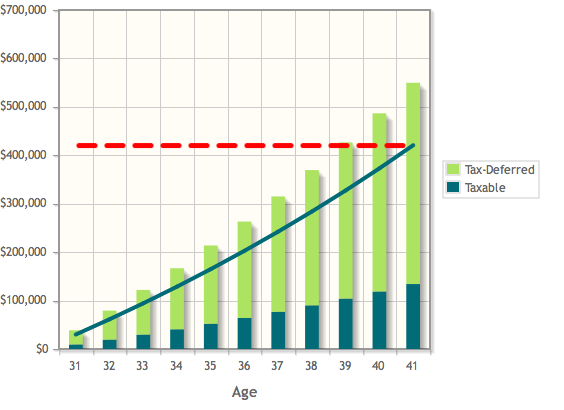

- Dark green line: invest in solely taxable accounts

- Bar graph: max out tax deferred accounts (401(k) and IRA)

- Slight flaw in the math here. Assumes you only need 400k to retire possibly.

- Roth IRA conversion ladder

- Assume you have a large amount of money in your 401(k) and Traditional IRA at age 39. You choose to retire early

- Move the 401(k) to your traditional IRA (not too hard)

- IRS rules say that you can convert a Traditional IRA to a Roth IRA, as long as you pay the income tax on the conversion. But, if you time this with the low income of early retirement, you won’t have to pay tax on the conversion. Then you have avoided paying any taxes on any of the money.

- This begins to look like this:

- Can set up early withdrawals from IRAs by setting up SEPPs (Substantially Equal Periodic Payments)

- Extra explanation here

Stepping Away from REITS

- When I read these articles, he had already stepped away from REITS, so I skipped mentioning it until now

- The short form is this. Land is not fundamentally a productive asset. It does not increase in productivity.

- They solely will grow at range of inflation or growth of the housing market. That’s not a terrible thing, but if the fundamental premise here is that the best investment is the stock market, this is just a low-risk low-reward solution to hedge against hyperinflation. But the realistic answer is that if hyperinflation hits, you might be screwed anyway. But if you look at the stock market during the German hyperinflation, nothing too bad happened.

- “In prison cigarettes are always worth something, Buy them now and hold for future resale. Now that’s an inflation hedge. Maybe sugar too.”

Selecting your Asset Allocation

- To reiterate. When trying to generate wealth (i.e. have a job) invest 100% stocks and the ever classic VTSAX

- When trying to preserve wealth, add bonds as the income from this is the only thing you are now living off of.

- Some studies say that in the wealth acquisition stage in live, you actually may do better by having 10-20% in stocks

- The real winner is very hard to tell, but in general you would never really know which one would win.

- Once a year you would want to rebalance funds to maintain allocation percentages and shift as the market moves up vs down. Rebalancing means sell the ones that are performing well, and buy more of the ones that are lagging behind.

- In short, bonds smooth the ride, and stocks power the returns. Find the balance that doesn’t tear you up inside.

RMDs, the Ugly Surprise at the End of the Tax-Deferred Rainbow

- Except for a Roth IRA, all tax-advantaged buckets have required minimum distributions (RMDs) that begin at age 70.5. This includes Roth 401(k)s. If you do not withdraw these RMDs the U.S govt. will take 50% of your entire account

- Thus, it may force us to pay taxes, just because these withdrawals are required.

- This is why the roll into a Roth IRA strategy is such a good idea

HSAs, More Than Just a Way to Pay your Medical Bills.

- Contributions are tax deductible. It is free of Social Security and Medicare taxes if paid through your employer

- You can use your HSA to pay the health care costs of your spouse and dependents, even if they are not covered by your insurance plan. On top of that they include dental and vision.

- It is inheritable for your spouse, and becomes income for your children.

- In an FSA (flexible spendings accounts) the money you don’t spend this year is forfeited. The money in your HSA and all it earns will stay yours.

- You are not required to pay your medical bills with HSA. You can pay out of pocket and let the HSA grow. As long as you keep the medical receipts you can withdraw money from it tax and penalty free any time, even years later.

- You can invest it anywhere. Once you hit the age of 65, you can withdraw for any purpose penalty free, but have to pay taxes unless its used for medical expenses.

- No RMDs…Yet! The law can add this in, but for now you have a combination Roth IRA and regular IRA (since withdrawals are tax-free, and contributions are tax-deductible)

Pulling the 4%

- At some point you can reach a point where your assets pay the bills rather than your labor. At that point your 401(k) will become an IRA, so you will have IRA, Roth IRA, and Taxable things.

- Online banking things allow you to withdraw pretty easily

- Here are the basic principles. Reinvest all gains, BUT 4%. Do not purely try to live off only the income, but rather set a definite percentage and take that and let the rest grow. As you close in on 70, slowly shift everything to a Roth. And then at 70 cut off 4% withdrawals, and then switch to RMDs

- He gives further logistics on how he does it, but in general that seems relatively personal. Feel free to take a look

Why I Don’t Like Dollar Cost Averaging

- Dollar Cost Averaging is when you take some money, divide it into equal parts and then invest those parts at specific times on an extended period

- This just means you are betting the market will drop over the next time T. If it rises over the that time period in T, you are net losing money.

- Between 1970 - 2013, the market was up 33/43 years or 77% of the time. Thus, the math doesn’t really check out too much

- Obviously since you only really get paid periodically, you do inadvertently do this, but do not add extra delays beyond that.

Debt - The Unacceptable Burden

- Basically debt screws you. Avoid it. Period. As much as humanly possible

- Pay off debts as fast as you possibly can.

- Even mortgages are not good debt. Houses are not an investment.

Collins vs. Vanguard

- A friend had a meeting with a Vanguard advisor. He suggests a different distribution (VBTLX and VTSAX make up 100% of collins, 30% of advisors)

- But in general it still follows 70% stocks, 30% bonds so that’s fine

- In general, this article is a thought exercise where he reiterates why he says the things that he says and questions the Vanguard analyst. It doesn’t seem worthwhile to transcribe this over here, you should take a look yourself.

Too hot. Too cold. Not pure enough.

- Too hot == when you have too much invested in stocks and you aren’t able to handle it. I.E about to live off your savings, you want to lower your investments in stocks to lower risk basically.

- This is really an article about how he is chastised for either being too aggressive or not aggressive enough.

- His short answer is, nothing ground-breaking destructive is going to happen, and its impossible to figure out which things will outperform the overall stock market

- Then there are the people who say it is not pure enough. Basically you are funding companies that are shady by these whole stock market indices. He made his peace with it by donating on the other end. In general if you want your money to earn money for you, worry about nothing else.

Why you should not be in the stock market

- We are way more loss averse than we are gain driven pretty much

- Thus we need to remember that there is no loss, the market will always go up. Convince yourself of this

- When the market crashes selling is not an option

Optimism

- Seriously, be optimistic. If anything economically breaks up wide open, you’re pretty much fucked anyway. No money survives regardless, so why worry about it?

- Nothing lasts forever, so if the US goes south, invest in the total world stock market instead

- We really need to avoid this thinking:

How to unload your unwanted stocks and funds

- For Tax Advantaged Accounts

- IRAs

- Buy and sell without tax considerations

- 401(k), other employer sponsored plans -Once again investments can be moved here without tax considerations -Taxable accounts -You are taxed, relative to your income levels.

- Keep an eye on tax laws here cuz they change all the time

- IRAs